Companies report ESG data for a variety of reasons. Some are (or will be) required by regulation to disclose ESG practices. Others are directed by their board, shareholders, or business partners to show progress on ESG metrics. Still others prioritise ESG voluntarily, as a means of engaging employees or gaining market advantage.

ESG Reporting

Get ready for ESG reporting requirements

New regulations—along with customer and shareholder demands—are calling for new levels of corporate accountability on Environmental, Social, and Governance (ESG) metrics and practices. Learn what ESG includes, what the regulations require you to disclose, and how to prepare your company for the future of ESG reporting.

What is ESG reporting?

ESG reporting spans the full lifecycle of collecting, analysing, disclosing, and taking action on environmental, social, and governance data. This data usually includes environmental data, such as a company’s greenhouse gas emissions, pollution, water, and land use; social data such as workforce diversity and worker conditions; and information on business conduct and ethical practices.

Which companies must report ESG data?

Many companies are required to disclose, or will be required to disclose in the near future, under the European Union’s Corporate Sustainability Reporting Directive (CSRD). Others choose to disclose ESG data voluntarily, such as through CDP (formerly known as the Carbon Disclosure Project). Companies that are part of ESG investment funds, and companies seeking to get an ESG rating, are also required to share their ESG data.

What are the ESG reporting requirements?

Use this table to understand the different ESG reporting requirements, and what they require.

Global ESG regulations

Framework | Applies to | What's required | ||

|---|---|---|---|---|

The Corporate Sustainability Reporting Directive (CSRD) | Companies within and outside of the European Union that are part of the following cohorts:

| The CSRD’s technical standards, known as the ESRS, have 12 draft standards. Two are cross-cutting—general requirements and general disclosures—which cover broad environmental, social, and governance topics. Beyond those, there are 5 Environmental, 4 Social, and 1 Governance topical standards that lay out more detailed disclosures and metrics on specific topics. | ||

UK & European ESG regulations

Framework | Applies to | What's required | ||

|---|---|---|---|---|

Streamlined Energy and Carbon Reporting (SECR) | All UK quoted companies, and all private companies and nonprofits with two or more of (1) 250+ employees, (2) £36m+ revenue, (3) £18m+ balance sheet. | SECR mandates disclosure of three energy and emissions metrics (total energy consumption, scope 1 and 2 emissions, and emissions intensity) along with commentary on actions taken to improve energy efficiency and methodology used to calculate metrics. These disclosures must be included within—or in some cases alongside—2022 financial results reported in 2023. | ||

UK Financial Conduct Authority’s TCFD requirement for listed firms | All companies with UK-listed shares or global depositary receipts | The UK Financial Conduct Authority (FCA) requires filers to include a standard TCFD report each year, inclusive of Scope 3 emissions from supply chains. While this rule was originally limited to premium listed firms, the program was extended to include standard listed firms for accounting periods beginning on or after January 1st, 2022—ie, for all reports in 2023. | ||

US ESG regulations

Framework | Applies to | What's required | ||

|---|---|---|---|---|

US Securities & Exchange Commission (SEC) climate disclosure rule | All public companies with an existing SEC reporting requirement, including non-US companies with US-traded shares (that already file a Form 20-F). | While the SEC hasn’t released their final rule yet (expected late 2023), their draft proposal called for full transparency on both carbon emissions and climate risks. Companies will need to disclose comprehensive emissions data—along with their climate action plans and their performance against those plans. The required format will likely be similar to a TCFD disclosure. Final reporting deadlines will almost certainly be later than those included in the draft proposal, most likely starting with disclosure in 2025, on 2024 data. Private companies are exempt, but many investors will ask companies on a path to IPO to start reporting on this data (at least internally) in 2024. | ||

US SEC ESG fund-labelling rules — proposed | Any investment company or advisor currently required by the SEC to file one of the following forms: N-1A, N-2, N-CSR, N8B-2, S-6, N-CEN, or ADV Part 2A. This covers most registered investment funds and some investment advisor. | The first proposal sets disclosure requirements according to fund categorization:

| ||

California SB 253 & SB 261 (California Climate Accountability Package) — proposed | SB 253: Public and private companies doing business in California with annual revenue in excess of $1 billion SB 261: US entities that do business in California with annual revenue of at least $500M | SB 253, the Climate Corporate Data Accountability Act, requires some public and private companies doing business in California to disclose their scope 1, 2, and 3 emissions, beginning in 2026 on 2025 data. Scope 3 emissions reporting would not be required until 2027 on 2026 data. SB 261, the Climate-Related Financial Risk Act, would require certain entities doing business in California to prepare and submit climate-related financial risk reports that cover climate-related financial risks consistent with recommendations from the Task Force on Climate-Related Financial Disclosure (TCFD) framework. The first report would be required to be prepared by December 31, 2024. | ||

US federal contractors rule — proposed | All vendors to the US government with significant ($7.5m-$50m) or major ($50m+) annual federal contracting revenues. Companies whose federal contracts make up 80% or more of their total annual revenues are exempt. | Significant contractors must disclose scope 1 and 2 emissions, while major contractors must additionally disclose their scope 3 emissions, complete a TCFD-compliant climate risk assessment, and set a science-based emissions reduction target. | ||

How to prepare ESG disclosures

01

Gather the right data

Since you’ll be gathering data from across your organisation, it’s important to use a data platform that lets you ingest data directly from existing business systems, such as ADP or Workday, as well as upload different file formats.

02

Prepare for disclosure

If you’re using a software platform like Watershed to manage your ESG data, you’ll benefit from automatic data cleanup, gap identification (and, in some cases, estimations needed to fill gaps), and anomaly detection to ensure your data is as clean as possible. Next, you’ll need to format your data to meet the requirements of the disclosure framework you’re reporting to, such as CDP or the CSRD.

03

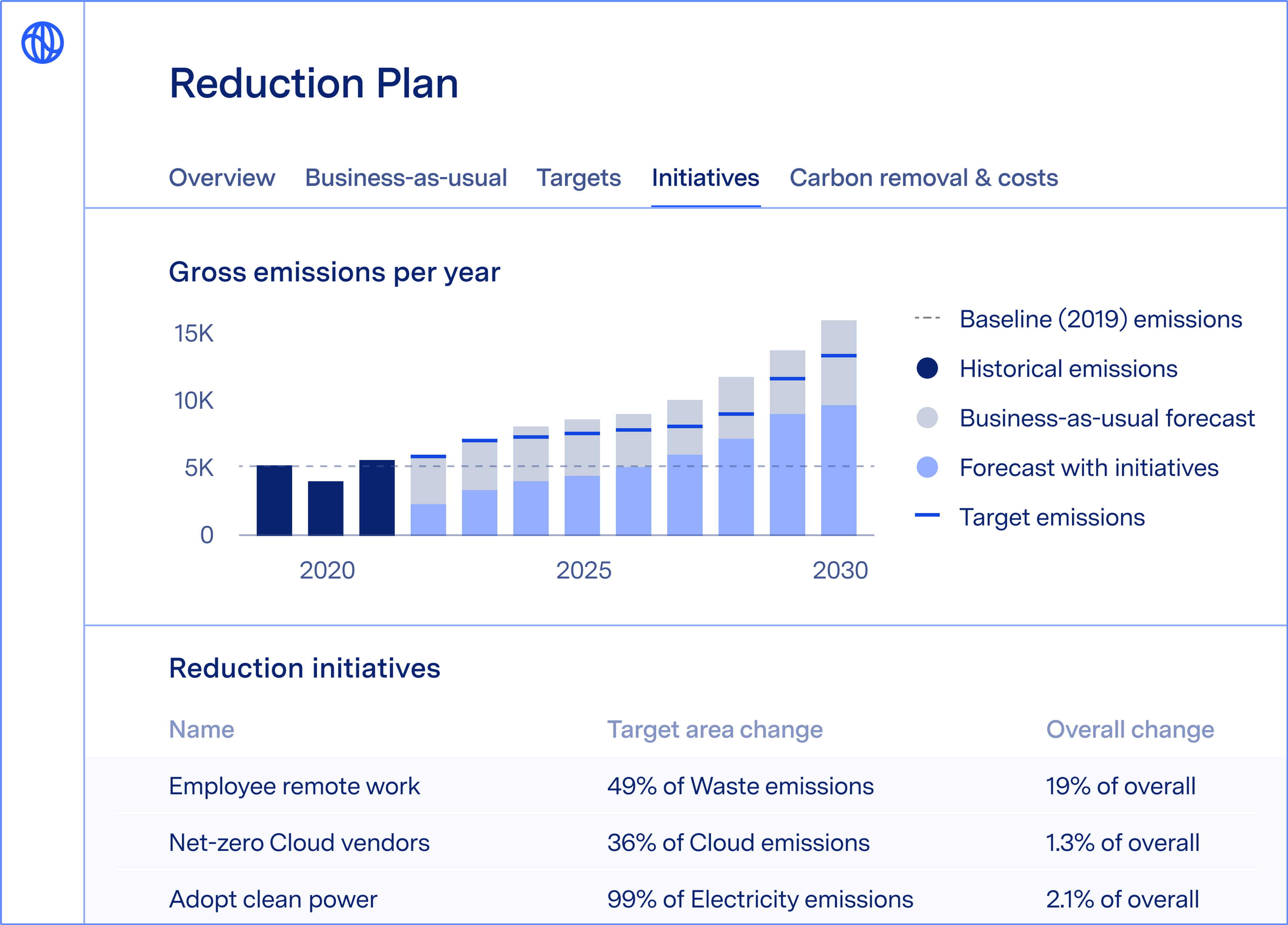

Take action

Reporting is just the first step: once you've disclosed ESG practices, you’ll be expected to show progress from one year to the next. Investing in a granular, multi-region carbon footprint, for example, helps you identify the right levers to reduce emissions and show improvement.

ESG Glossary: key ESG terms to know

Navigating the world of ESG reporting isn’t easy—especially when it comes to the alphabet soup of different standards, frameworks, and governing bodies. Here’s a handy guide to common terms and acronyms.

ESG terminology | Definition | ||

|---|---|---|---|

ESG (Environmental, Social, & Governance) | ESG is the umbrella term used for most corporate responsibility practices, performance metrics, and initiatives. It encompasses environmental and sustainability practices, such as reducing greenhouse gas emissions and using land and natural resources responsibly; social practices such as worker conditions; and corporate governance. | ||

CSRD (Corporate Sustainability Reporting Directive) | The CSRD is the European Union’s comprehensive ESG regulation. It applies to more than 50,000 companies within and beyond Europe and includes disclosures across all categories of environmental, social, and governance practices. Learn more → | ||

NFRD (Non-Financial Reporting Directive) | The EU’s previous ESG disclosures programme. While revised in 2019 to include TCFD questions, the update was optional for filers, and NFRD will be replaced by the CSRD beginning in 2025. | ||

ESRS (European Sustainability Reporting Standards) | ESRS (European Sustainability Reporting Standards)The EU’s technical rules governing disclosures under the CSRD. The ESRS include 4 types of disclosures: General disclosures, which are required for all companies; Environmental standards; Social standards; and a Governance standard. Learn more → | ||

ISSB (International Sustainability Standards Board) | The body responsible for publishing a new set of global ESG disclosure standards in June 2023. The new standards aim to “bring to an end the alphabet soup in the market” and provide a single, unified framework for sustainability reporting. Read our guide → | ||

IFRS (International Financial Reporting Standards) | The IFRS Foundation is the nonprofit parent organisation that created the ISSB. Its stated purpose is to harmonise the world around a common set of disclosure rules that are consistent, complete, comparable, and verifiable. | ||

SASB (Sustainability Accounting Standards Board) | SASB is a nonprofit organization responsible for developing standards for financial-related sustainability disclosures. According to IFRS, “SASB Standards identify the subset of environmental, social and governance issues most relevant to financial performance and enterprise value for 77 industries.” | ||

TCFD (Taskforce on Climate-related Financial Disclosures) | A set of 11 questions has served as a global baseline for climate disclosures. While many programmes now require more than just TCFD answers, these answers are a reporting backbone that can be reused in multiple places. | ||

SFDR (Sustainable Finance Disclosure Regulation) | The EU’s programme for creating ESG “nutritional labels” for financial products and the firms that market them—giving buyers and investors context on climate impact and any associated risks. SFDR will pair closely with the EU’s Green Taxonomy, the new rulebook on what counts as officially green. Learn more → | ||

SECR (Streamlined Energy and Carbon Reporting) | The UK government’s requirement for large companies to disclose electricity usage and carbon emissions alongside their financials each year. SECR applies to quoted companies of any size, large unquoted companies, and large LLPs. Learn more → | ||

SEC (US Securities & Exchange Commission) | The US regulatory body responsible for proposals that would require federal contractors, public companies, and ESG funds to disclose information about their ESG practices. | ||

FCA (Financial Conduct Authority) | The UK’s financial regulatory body, which requires large asset managers and owners—including life insurers and FCA-regulated pension providers—to offer full transparency on the climate aspects of their portfolios. Learn more → | ||

GHG Protocol | The Greenhouse Gas Protocol defines the standards for emissions measurement used by many companies and governments to reduce emissions. | ||

SBT (Science-Based Targets) | The Science-Based Targets initiative sets the standard for emissions-reduction targets used by many companies and governments around the world. According to SBTI, targets qualify as “science-based” if they apply the latest climate science on what’s needed to meet the Paris Agreement goal of limiting global warming to 1.5°C above pre-industrial levels. | ||